As famous, the curiosity rate on Direct Unsubsidized Loans will vary according to whether or not the pupil can be an undergraduate pupil or maybe a graduate/professional college student. Thus, special origination needs might be essential for any undergraduate university student who received a loan which was first disbursed on or following July 1, who becomes a graduate/Expert pupil through the loan time period. In this sort of circumstances, the institution must terminate any scheduled (or genuine) disbursements that will have occurred when the scholar might be a graduate/Specialist college student and modify the loan’s loan interval conclusion date to coincide with the borrower’s undergraduate duration of enrollment.

Banks that interact in leveraged lending transactions must think about and carry out all applicable areas and sections on the 2013 advice.

Underneath the law, the index amount is determined yearly as the “significant yield of the 10-12 months Treasury note” auctioned at the final auction held ahead of the June 1 preceding the July 1 of your year for which the rate is going to be productive, plus a statutorily defined “include-on”.

Should the projected potential to pay for down personal debt from cash flow is nominal, the credit will often be adversely rated, even if it's been recently underwritten. For distressed leveraged borrowers, where a percentage of the loan is probably not shielded by pledged property or perhaps a well-supported EV, the danger rating will frequently mirror a far more significant classification or nonaccrual position.

Pipeline management highlights the necessity to precisely evaluate publicity on the well timed foundation, the significance of insurance policies and processes that handle failed transactions and standard market disruption, and the need to periodically worry check the pipeline.

Increase a note concerning this click here bill. Your note is for you personally and will not be shared with any one. As you really are a member of panel, your positions on legislation and notes underneath will be shared With all the panel administrators. (Additional Facts)

Notwithstanding the previous paragraphs of this subsection, any Federal Immediate Consolidation Loan for which the application is been given on or soon after July 1, 2013, shall bear fascination at an annual rate over the unpaid principal harmony on the loan which is equal into the weighted regular in the interest premiums about the loans consolidated, rounded to the nearest better a single-eighth of 1 %.

Figuring out a financial institution’s risk management framework involves the express involvement of management along with the board in location a bank’s guidelines and its portfolio and pipeline possibility restrictions.

Tension testing outlines that a lender should really accomplish worry tests on leveraged loans held in its portfolio together with All those planned for distribution.

The requirements also needs to contemplate whether or not the borrower’s money composition is sustainable irrespective of if the transaction is underwritten to carry or With all the intent to distribute.

As pointed out the incorporate-on will vary based on the variety of loan and the student’s grade stage. Each loan variety also has a highest fascination level (or cap).

The establishment would then originate another Direct Unsubsidized Loan for your time period when the coed might be a graduate or Skilled pupil. In many circumstances, the educational yr for the two loans will be the identical. Adjustments to loan period or academic calendar year dates will have to adjust to DCL GEN-thirteen-13.

(A) present estimates relying on precise info dependant on previous, present-day, and projected info as to the suitable index and mark-up rate to the Federal Government's price of borrowing that may allow the Federal Govt to effectively administer and cover the price of the Federal university student plans approved less than title IV of the Higher Schooling Act of 1965 ( twenty U.

Participations purchased describes basic concerns necessary if banks purchase participations in leveraged lending transactions such as policies, credit acceptance standards, and in-home limits that would be demanded Should the lender have been originating the loan.

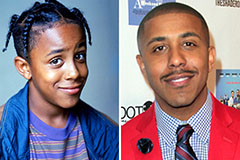

Bug Hall Then & Now!

Bug Hall Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now!